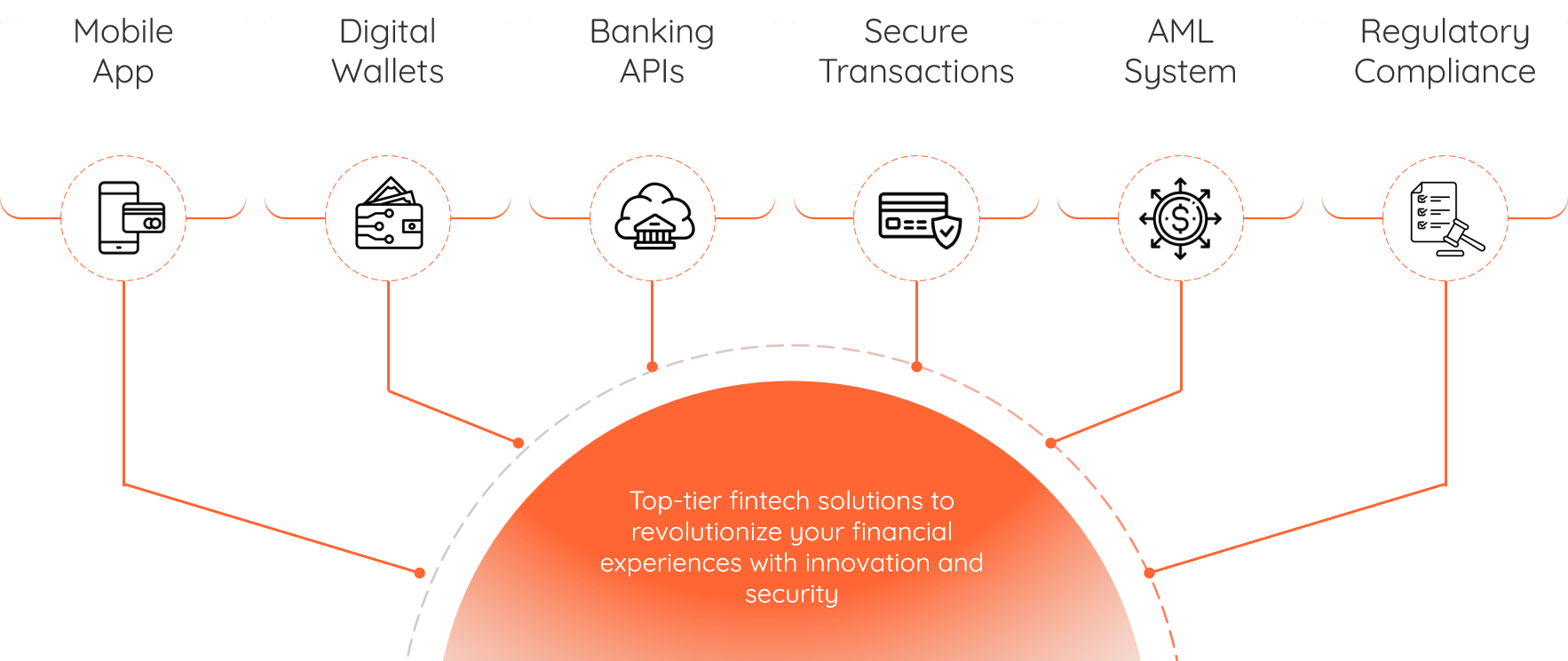

Secure and Innovative Fintech Solutions

Empower your financial operations with cutting-edge Mobile Apps, Digital Wallets, Banking APIs, Secure Transactions, AML Systems, and Regulatory Compliance Solutions. Our fintech expertise ensures seamless, secure, and compliant financial experiences, revolutionizing the way you manage transactions and digital payments.

Mobile App

Overview: Developing secure and user-friendly mobile banking applications for seamless financial transactions.

Benefits:

- Convenient access to banking services.

- Enhanced security with biometric authentication.

- Real-time transaction tracking.

Digital Wallets

Overview: Providing digital wallet solutions for easy and secure online payments and money transfers.

Benefits:

- Fast and seamless transactions.

- Secure storage of payment details.

- Integration with multiple payment methods.

Banking APIs

Overview: Offering API solutions to enable seamless connectivity between financial institutions and third-party services.

Benefits:

- Secure and efficient financial data exchange.

- Improved banking service automation.

- Enhanced customer experience through open banking.

Secure Transactions

Overview: Implementing advanced security measures to protect digital transactions from fraud and cyber threats.

Benefits:

- End-to-end encryption for data security.

- Fraud detection and prevention mechanisms.

- Compliance with global security standards.

AML System

Overview: Providing Anti-Money Laundering (AML) solutions to detect and prevent financial fraud.

Benefits:

- Automated risk assessment and monitoring.

- Compliance with international AML regulations.

- Real-time detection of suspicious activities.

Regulatory Compliance

Overview: Ensuring financial institutions meet legal and regulatory requirements through compliance solutions.

Benefits:

- Adherence to local and global financial regulations.

- Automated compliance reporting.

- Reduced risk of regulatory penalties.

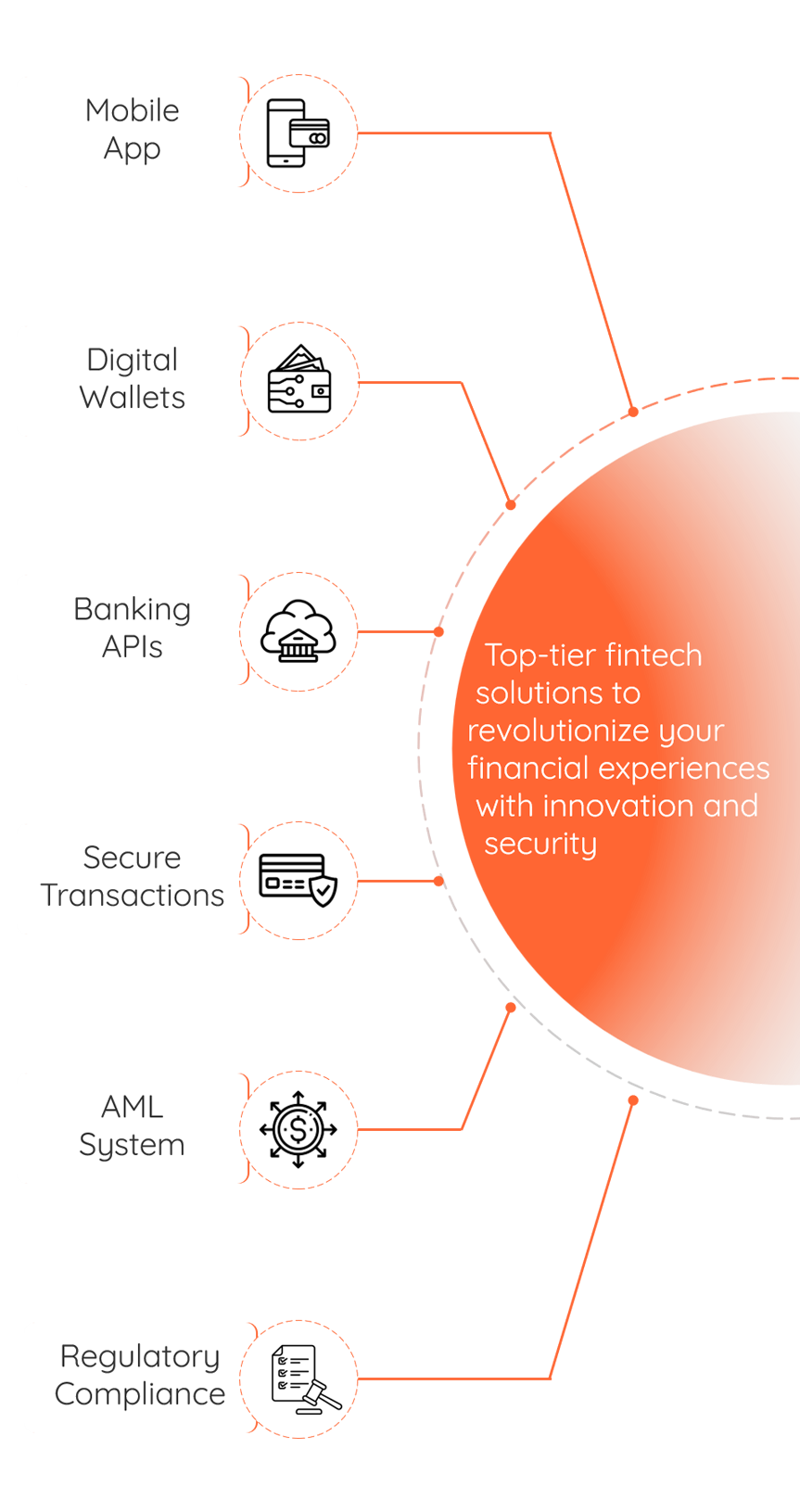

Mobile App

Overview: Developing secure and user-friendly mobile banking applications for seamless financial transactions.

Benefits:

- Convenient access to banking services.

- Enhanced security with biometric authentication.

- Real-time transaction tracking.

Digital Wallets

Overview: Providing digital wallet solutions for easy and secure online payments and money transfers.

Benefits:

- Fast and seamless transactions.

- Secure storage of payment details.

- Integration with multiple payment methods.

Banking APIs

Overview: Offering API solutions to enable seamless connectivity between financial institutions and third-party services.

Benefits:

- Secure and efficient financial data exchange.

- Improved banking service automation.

- Enhanced customer experience through open banking.

Secure Transactions

Overview: Implementing advanced security measures to protect digital transactions from fraud and cyber threats.

Benefits:

- End-to-end encryption for data security.

- Fraud detection and prevention mechanisms.

- Compliance with global security standards.

AML System

Overview: Providing Anti-Money Laundering (AML) solutions to detect and prevent financial fraud.

Benefits:

- Automated risk assessment and monitoring.

- Compliance with international AML regulations.

- Real-time detection of suspicious activities.

Regulatory Compliance

Overview: Ensuring financial institutions meet legal and regulatory requirements through compliance solutions.

Benefits:

- Adherence to local and global financial regulations.

- Automated compliance reporting.

- Reduced risk of regulatory penalties.